Not known Details About Eb5 Immigrant Investor Program

Table of ContentsMore About Eb5 Immigrant Investor Program6 Easy Facts About Eb5 Immigrant Investor Program ExplainedThe Eb5 Immigrant Investor Program PDFsEb5 Immigrant Investor Program for DummiesSome Known Incorrect Statements About Eb5 Immigrant Investor Program The Eb5 Immigrant Investor Program PDFs

Despite being much less preferred, various other pathways to obtaining a Portugal Golden Visa consist of financial investments in financial backing or personal equity funds, existing or new organization entities, funding transfers, and contributions to sustain scientific, technical, creative and social developments. Holders of a Portuguese resident license can likewise work and research in the country without the demand of obtaining additional licenses.

The Main Principles Of Eb5 Immigrant Investor Program

Capitalists must have both a successful entrepreneurial history and a significant service record in order to use. They may include their partner and their kids under 21-years- old on their application for irreversible house. Successful candidates will obtain an eco-friendly five-year reentry authorization, which permits for open traveling in and out of Singapore.

Eb5 Immigrant Investor Program Can Be Fun For Anyone

Applicants can invest $400,000 in government accepted property that is resalable after 5 years. Or they can invest $200,000 in federal government accepted realty that is resalable after 7 years. All while paying federal government charges. Or they can give away $150,000 to the federal government's Sustainable Development Fund and pay lesser government charges.

This is the main advantage of immigrating to Switzerland contrasted to various other high tax nations. In order to be eligible for the program, candidates should Be over the age of 18 Not be employed or inhabited in Switzerland Not have Swiss citizenship, it has to be their very first time living in Switzerland Have rented out or bought residence in Switzerland Give a long list of recognition records, consisting of tidy criminal document and good moral personality It takes about after payment to acquire a resident license.

Tier 1 visa holders stay in condition for regarding 3 years (relying on where the application was submitted) and must put on extend their stay if they desire to continue staying in the UK - EB5 Immigrant Investor Program. Prospects should have a peek at this website have personal properties that worth at even more than 2 million and have 1 numerous their very own money in the U.K

9 Simple Techniques For Eb5 Immigrant Investor Program

The Tier 1 (Business Owner) Visa is legitimate for three years and 4 months, with the choice to prolong the visa for an additional 2 years. The candidate may bring their reliant family participants. As soon as the business owner has actually been in the United Kingdom for 5 years, they can request uncertain entrust to stay.

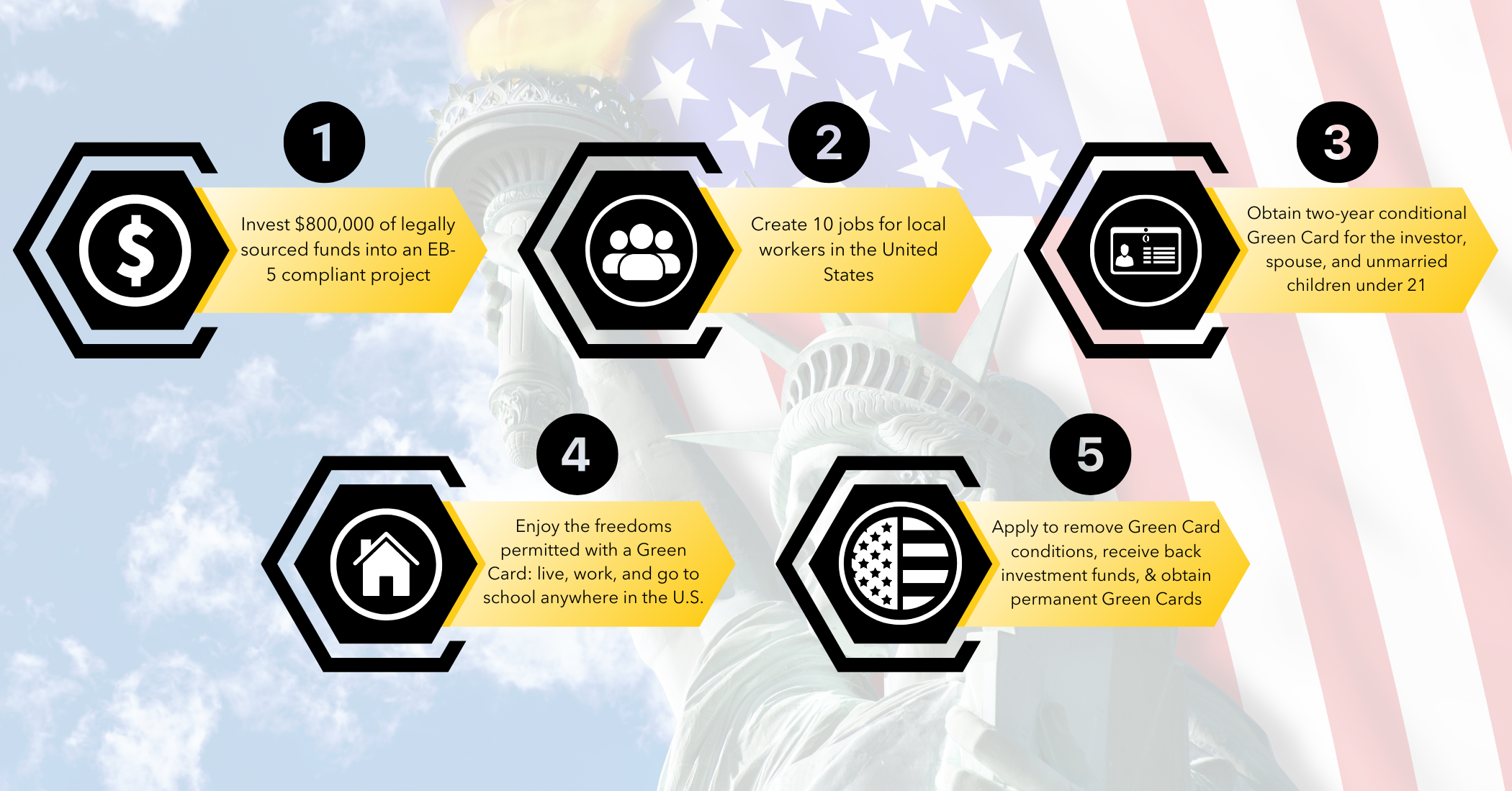

Financial investment migration has gotten on an upward trend for greater than 20 years. The Immigrant Capitalist Program, likewise referred to as the EB-5 Visa Program, was read this developed by the U.S. Congress in 1990 under the Migration Act of 1990 or IMMACT90. Its primary purpose: to boost the U.S. economy with job production and funding financial investment by foreign capitalists.

This included decreasing the minimal investment from $1 million to $500,000. Over time, modifications have actually increased the minimal financial investment to $800,000 in TEAs and $1.05 million in other locations.

The Buzz on Eb5 Immigrant Investor Program

Developers in rural locations, high joblessness locations, and framework jobs can benefit from a dedicated pool of visas. Financiers targeting these particular areas have actually a raised possibility of visa accessibility.

Developers working on public jobs tasks can currently qualify for EB-5 financing. Financiers now have the possibility to spend in government-backed facilities jobs. Specific USCIS interpretations under previous legislation are secured by law, consisting of restricted redemption and financial debt setups, and talented and loaned mutual fund. Developers require to ensure their financial investment plans conform with the brand-new statutory definitions that impact them under united state

immigration regulation. EB5 Immigrant Investor Program. Investors should understand the approved kinds of mutual fund and plans. The RIA has actually established demands for issues such as redeployment, unlike prior to in prior variations of the law. Investors and their family members already legitimately in visit their website the U.S. and qualified for a visa number might concurrently file applications for modification of standing in addition to or while awaiting adjudication of the capitalist's I-526 request.

This streamlines the process for financiers currently in the united state, expediting their capability to readjust standing and avoiding consular visa handling. Country tasks receive priority in USCIS processing. This encourages designers to launch tasks in backwoods as a result of the much faster processing times. Investors searching for a quicker handling time could be more likely to purchase rural projects.

The Ultimate Guide To Eb5 Immigrant Investor Program

Looking for united state federal government details and services?

To qualify, candidates must spend in new or at-risk business business and develop permanent settings for 10 qualifying employees. The United state economic climate advantages most when a place is at danger and the brand-new financier can supply a working establishment with full time work.

TEAs were implemented right into the investor visa program to motivate spending in locations with the best need. TEAs can be country locations or areas that experience high unemployment. A country area is: beyond common municipal statistical locations (MSA), which is a city and the bordering areas within the outer limit of a city or community with a populace of 20,000 or more A high joblessness area: has experienced joblessness of at the very least 150% of the national typical rate An EB-5 regional center can be a public or personal financial unit that promotes financial growth.